Yes, Turbo Debt can be an effective tool for reducing unsecured debts, including credit cards, medical bills, and personal loans, especially if you are behind on payments and facing unmanageable balances.

Turbo Debt operates as a debt settlement company that negotiates directly with creditors to reduce your total owed amount, helping you avoid bankruptcy while paying less than your full balance.

It is not a quick fix, and it can impact your credit score initially, but for many, the trade-off is worth it: clients report average savings of 46% on their enrolled debt before fees.

Turbo Debt has settled over $15 billion in debt for 500,000+ clients, illustrating that, when used correctly, it can help you regain control of your finances, reduce stress, and move toward a debt-free future.

Who It Helps

Turbo Debt is a debt settlement company that negotiates on your behalf with your creditors to settle your unsecured debts for less than you owe. It is specifically for individuals who have fallen behind on payments and cannot keep up with their current debt obligations.

- Credit cards

- Medical bills

- Personal loans

- Certain private student loans

- Collection accounts

- Mortgages

- Auto loans

- Federal student loans

- Secured loans

Turbo Debt offers a structured alternative to bankruptcy, providing relief to individuals facing collections, wage garnishments, and constant creditor calls.

Why People Choose Turbo Debt

Millions of Americans face debt that spirals out of control due to job loss, medical emergencies, rising living costs, and high-interest credit cards.

According to Experian, the average American carries $6,501 in credit card debt, and many struggle to keep up with minimum payments while interest rates continue to accumulate.

Turbo Debt offers a path to reduce debt without filing for bankruptcy while helping clients regain control over their financial lives and reduce stress.

How Turbo Debt Works: Step-by-Step

View this post on Instagram

Step 1: Free Consultation and Assessment

Your journey begins with a free consultation, where a Turbo Debt advisor reviews your debts, income, and monthly expenses. This assessment helps you understand your options, estimate potential savings, and determine your eligibility for the program.

Step 2: Enrollment and Dedicated Account Setup

After deciding to proceed, you enroll your eligible debts into the program and set up a dedicated FDIC-insured account in your name, which will be used to fund settlements. Instead of paying your creditors directly, you deposit an agreed monthly amount into this account.

Step 3: Stopping Payments to Creditors

To encourage creditors to negotiate, you stop making payments on the enrolled debts. This is necessary to demonstrate financial hardship and leverage negotiation opportunities.

Step 4: Negotiation with Creditors

Once your account has accumulated sufficient funds, Turbo Debt’s team begins negotiating settlements with your creditors, aiming to settle for significantly less than your full balance.

Step 5: Settlement Payments

After agreements are reached, Turbo Debt uses the funds from your dedicated account to pay the negotiated settlement amounts. This process continues creditor by creditor until all enrolled debts are resolved.

Step 6: Program Completion

Clients typically complete Turbo Debt’s program within 24 to 48 months, depending on their funding speed and creditor responsiveness. Once completed, you will have resolved your enrolled debts, providing a clean financial slate.

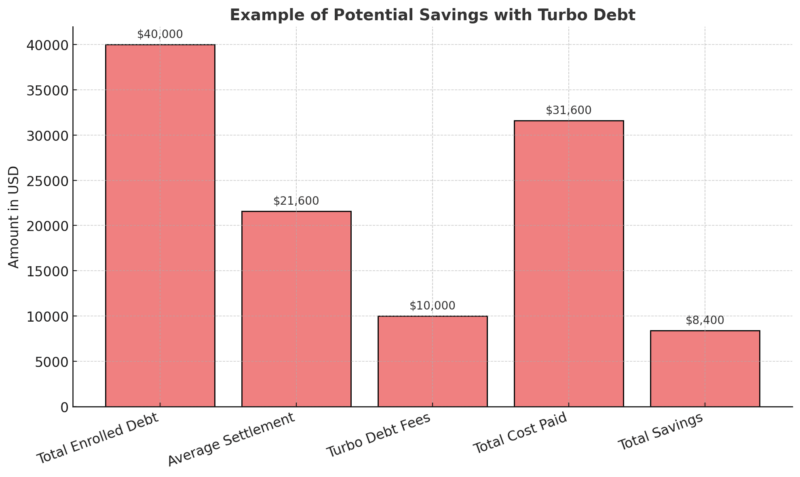

Example of Potential Savings with Turbo Debt

To understand the potential savings with Turbo Debt, consider this realistic example:

Enrolled Debt

Average Settlement (46% savings)

Fees (25%)

Total Paid

Total Savings

$20,000

$10,800

$5,000

$15,800

$4,200

$30,000

$16,200

$7,500

$23,700

$6,300

$50,000

$27,000

$12,500

$39,500

$10,500

Costs and Fees

Turbo Debt typically charges 20–25% of the total enrolled debt as its service fee, which is paid gradually as settlements occur, not upfront. This fee is only charged when a debt is successfully settled, ensuring there are no fees without results.

Impact on Credit Score

Using Turbo Debt can initially lower your credit score since the program requires you to stop making payments to creditors. Accounts may be sent to collections, and late payment marks will appear on your credit report.

However, as debts are settled and your total debt decreases, many clients begin to see credit improvement over time due to:

- Reduced debt-to-income ratios

- Fewer open collections

- Elimination of charged-off balances

It is important to prioritize long-term debt freedom over temporary credit score dips, especially if your credit has already been impacted by missed payments.

Tax Implications

Forgiven debt amounts over $600 may be considered taxable income by the IRS.

However, if you qualify as insolvent (your debts exceed your assets), you may be able to exclude this income from your taxes. Turbo Debt can guide you in understanding these tax considerations or direct you to a tax professional for assistance.

Benefits of Using Turbo Debt

- Reduction of total unsecured debt by up to 40–50% before fees

- Relief from ongoing collection calls and creditor harassment

- No need for a new loan or additional credit checks

- Structured, clear timeline to becoming debt-free

- Avoidance of bankruptcy and its long-term impacts

- Professional negotiation on your behalf

Turbo Debt vs. Other Debt Relief Options

Option

What It Does

Pros

Cons

Turbo Debt

Negotiates with creditors to reduce debt

Potentially large savings, no new loans

Initial credit score impact

Debt Consolidation

Combining debts into one payment with lower interest

Easier payment management

Requires good credit, full repayment

Credit Counseling

Provides budgeting and payment strategies

May lower interest rates

No reduction in principal owed

Bankruptcy

Discharges debts legally

Wipes out qualifying debts

Severe credit damage, court process

Turbo Debt may be the best fit if you have significant unsecured debt you cannot manage, are behind on payments, and are looking to avoid bankruptcy while reducing your total debt.

Customer Reviews and Satisfaction

Turbo Debt maintains strong customer ratings, with many clients reporting:

- Clear communication and transparency throughout the process

- Relief from overwhelming debt within a structured program

- Professional, respectful treatment during a stressful time

On platforms like TrustPilot, Turbo Debt has earned a 4.9 out of 5-star average rating from thousands of users, reflecting consistent customer satisfaction with the results achieved.

Is Turbo Debt Right for You

Turbo Debt may be the right solution if:

- You have over $10,000 in unsecured debt

- You are unable to meet the minimum payments

- You are facing collections or creditor harassment

- You want to avoid bankruptcy while reducing your debt

- You understand and accept the credit score impact in exchange for debt relief

It may not be suitable if you are current on payments and can pay off your debts within a few years using budgeting or a debt snowball method.

Conclusion

@turbo.debt If you asked me on a deeper level…🥲 #TurboDebt #financialfreedom ♬ one more light – favsoundds

Turbo Debt offers a structured, realistic path toward debt freedom for individuals overwhelmed by unsecured debts. By leveraging professional negotiation, clients can reduce their total debt, stop creditor harassment, and avoid the consequences of bankruptcy, all while working within a clear repayment plan.

While the process involves an initial credit score drop and fees that should be carefully considered, the potential for substantial debt reduction and financial relief makes Turbo Debt a viable and often life-changing option for those who qualify.

If you are struggling with high-interest debt and feel trapped, exploring Turbo Debt could be your first step toward regaining financial control and building a stable future.