Cash flow keeps a business alive far more consistently than profit on paper. Profit can look impressive, yet cash shortages can stop operations instantly.

Many entrepreneurs learn too late that strong profit does not guarantee financial health.

Misconceptions about cash flow often lead to delayed reactions, last-minute borrowing, and unnecessary stress.

A proactive mindset allows problems to be prevented before they escalate.

A structured cash flow plan strengthens decision-making, improves confidence, and builds the stability needed for long-term growth.

Set Realistic Monthly Cash Flow Goals

Setting realistic goals starts with calculating the monthly burn rate. Burn rate shows how much money leaves the business during a normal month.

Short-term goals focus on month-to-month survival and stability, while long-term goals guide expansion, reserves, and strategic decisions.

Cash should be allocated with intention, including:

- 1 to 2 months of operating expenses

- 3 to 6 months of reserve money, depending on risk tolerance

- A portion dedicated to growth investments

A balanced cash structure prevents emergencies, reduces reliance on loans, and ensures that opportunities can be taken without hesitation.

Build a Monthly Cash Flow Plan

A strong monthly cash flow plan creates clarity, structure, and predictability. Many companies struggle not because they lack revenue, but because cash enters and exits at the wrong times.

A disciplined plan turns chaotic financial movement into an organized system that supports smarter decision-making.

A well-built plan becomes a foundation for agility, growth, and confidence.

Step #1: Analyze Historical Data

A clear review of historical data creates an accurate baseline.

Patterns in spending, income timing, and seasonal fluctuations become visible when past numbers are studied carefully.

Analyzing 6 to 12 months of inflows and outflows shows how money behaves across different periods, making it easier to predict upcoming movements.

A list of typical categories that should be examined includes the following:

- Payroll and benefits

- Software subscriptions

- Tax obligations

- Supplier payments

- Recurring client payments

- Loan repayments

- Marketing or advertising cycles

Strong categorization reveals where cash repeats consistently, where leaks appear, and where adjustments can offer immediate improvement.

Step #2: Forecast Future Cash Movement

A forward-looking forecast helps teams anticipate shifts instead of reacting to them.

A 13-week rolling forecast provides a flexible window that updates weekly and adjusts as new information arrives.

This method keeps attention sharp and allows corrections to be made before financial pressure begins to rise.

A forecasting model should include the following elements:

- Expected client payment timing

- Supplier terms and typical payment schedules

- Sales pipeline activity

- Operational commitments

- Seasonal or industry-specific cycles

Scenario planning strengthens awareness and prepares decision-makers for different outcomes.

Companies should build three versions of the forecast:

- Base-case scenario for expected results

- Best-case scenario for accelerated growth or quicker payments

- Worst-case scenario for delays or increased costs

Step #3: Establish Decision Triggers

Decision triggers act as warning signals that guide when action is needed.

Waiting until a crisis appears can damage operations, so clear thresholds should be defined early.

When cash hits a critical point or when receivables fall behind schedule, a pre-established response offers protection and direction.

Common triggers may include the following:

- Cash falling below a defined minimum balance

- Client payments delayed past a set number of days

- Project costs rising suddenly

- Inventory growing faster than sales

- Supplier prices increasing unexpectedly

Dashboards, automated alerts, and real-time monitoring tools support quick reactions.

A strong trigger system allows teams to respond early, adjust spending, or accelerate inflow efforts before financial strain develops.

Use Digital Tools and Cash Flow Forecasting Software

Digital tools offer speed, accuracy, and transparency.

Automated systems reduce manual work, remove data-entry mistakes, and connect the entire team with real-time financial information.

Software such as LivePlan, Datarails, and Agicap supports continuous updates, organizes financial data automatically, and alerts users to potential gaps or opportunities.

For executive-level insights into financial governance, boardroom strategy, and evolving market conditions, the Ned Capital Blog is a valuable resource, especially for NEDs and C-suite leaders overseeing long-term cash flow resilience.

Key advantages of digital tools include the following:

- Higher accuracy with less manual effort

- Real-time forecasting adjustments

- Easy collaboration between teams

- Clear visibility into upcoming risks

- Faster preparation for strategic decisions

Improve Incoming Cash Flow

A strong inflow strategy reduces stress and builds consistency.

Faster payments and predictable income streams make planning easier and reduce dependence on credit. Businesses gain more flexibility when inflows become stable and reliable.

Receivables can be accelerated in several ways. Examples include the following:

- Automated email reminders

- Early payment discounts

- Flexible online payment systems

- Digital invoicing platforms

Clients respond faster when barriers are removed and when reminders arrive automatically.

Additional inflow stability develops when revenue streams remain predictable. Companies can increase consistency by using:

- Subscription models

- Monthly retainers

- Scheduled service packages

- Recurring renewals

Control and Optimize Outgoing Cash Flow (Cash Outflows)

Outflows determine how long a business can operate without stress. Streamlining operations can cut unnecessary expenses and free up money for growth.

Lease vs. buy decisions should be made by comparing cost, maintenance requirements, and long-term impact.

Automated payment flows reduce human error and prevent missed deadlines.

Vendor and inventory management also shape cash flow health.

Companies benefit by negotiating better terms, requesting bulk discounts, and reviewing supplier relationships. JIT methods reduce excess stock and improve efficiency.

Removing slow-moving items stops money from getting trapped in inventory that does not generate returns.

Create and Maintain a Cash Reserve Fund

A cash reserve fund protects a business during unexpected disruptions.

Sudden delays, emergencies, or operational issues become less damaging when reserves exist.

Strong rules ensure reserves are used only for critical needs, preserving stability whenever pressure arises.

Effective maintenance of a reserve fund should include the following:

- Formal rules defining when the fund may be accessed

- Scheduled transfers that grow the reserve steadily

- Quarterly reviews to assess fund size and adequacy

- Adjustments based on company growth or industry changes

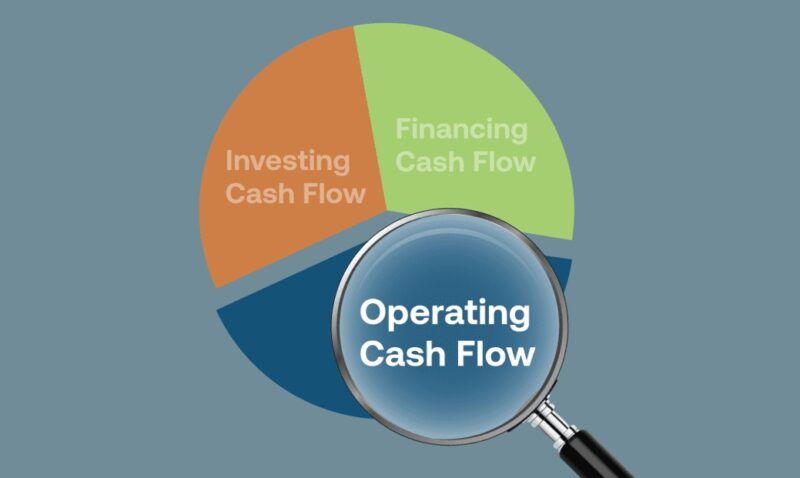

Monitor Key Cash Flow Metrics

Cash flow metrics reveal the condition of daily operations.

Key indicators include:

- Days Sales Outstanding (DSO)

- Cash Conversion Cycle

- Operating Cash Flow Ratio

- Cash Runway

Monthly reviews through dashboards provide clarity instantly.

Early detection of negative trends prevents unnecessary setbacks and keeps cash flow under control.

Final Thoughts

Continuous monitoring brings stability, confidence, and improved decision-making.

Businesses that track cash flow regularly adapt more quickly and respond with precision. Digital tools simplify forecasting, boost efficiency, and reduce stress.

Cash flow management leads to financial peace of mind, smoother operations, and long-term agility.