Health insurance is one of the most important components of employee benefits packages.

Providing strong health coverage shows that a company values its workforce and cares about their well-being. A well-structured plan can improve employee satisfaction, boost productivity, and increase retention.

When employees feel supported by their insurance, they are more likely to remain loyal to their employer and perform at their best.

Access to Quality Care

Employees want health insurance that does more than just cover the basics, it should give them confidence in their ability to access high-quality care whenever they need it.

Health insurance plans that offer flexibility, access to a broad network of providers, and top-tier medical care can significantly improve employee satisfaction and overall outcomes.

A plan that allows employees to maintain existing relationships with trusted doctors and receive specialized care without excessive costs strengthens the employee-employer relationship.

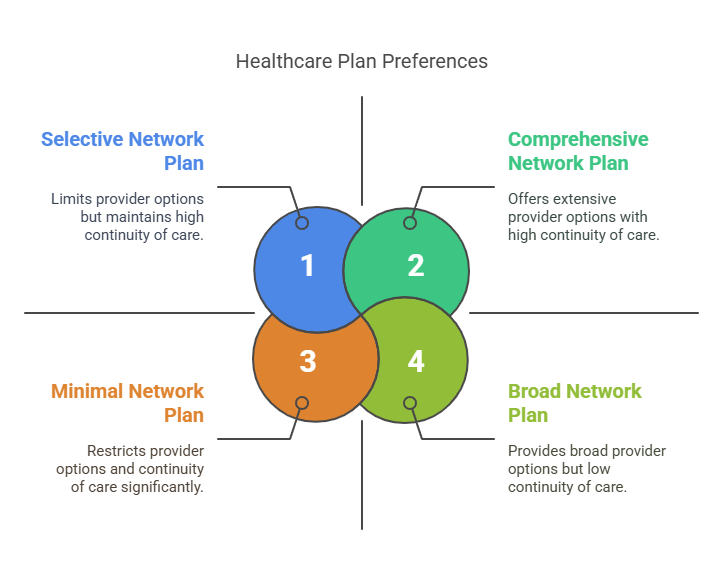

Strong Medical Network

Keeping existing healthcare providers is a top priority because familiar doctors understand their medical history and can provide more personalized care.

A plan that limits provider options or forces employees to switch doctors can create unnecessary stress and reduce confidence in the plan.

- Continuity of Care: Employees prefer health plans that allow them to continue seeing their current doctors and specialists without restrictions. Retaining relationships with established healthcare providers increases trust and improves health outcomes.

- Access to Preferred Facilities: In-network coverage should include reputable hospitals, clinics, and specialists. Employees want the option to receive care at well-known facilities where they feel comfortable and confident.

International and travel coverage:

- Employees who travel frequently for work or personal reasons value health plans that include coverage outside their home region or country.

- Without international coverage, employees risk facing high out-of-pocket costs or limited access to care when traveling.

- Comprehensive travel coverage ensures that employees receive timely and effective care, even while abroad.

Referral-free Access:

- Health plans that allow employees to see specialists or obtain certain types of care without needing a referral simplify the process and reduce waiting times.

- Eliminating the referral requirement gives employees more direct control over their healthcare decisions.

Extended provider network:

- Employees value health plans with a wide provider network that includes both general practitioners and specialists.

- A broad network allows employees to seek care in different geographic areas without paying higher out-of-network costs.

When employees have the freedom to choose their doctors and healthcare facilities, they are more likely to seek regular care and follow through with treatment plans.

Top-Tier Care and Specialists

Employees expect their health insurance to cover more than just basic doctor visits, they want confidence that they can access specialized care when required without excessive costs.

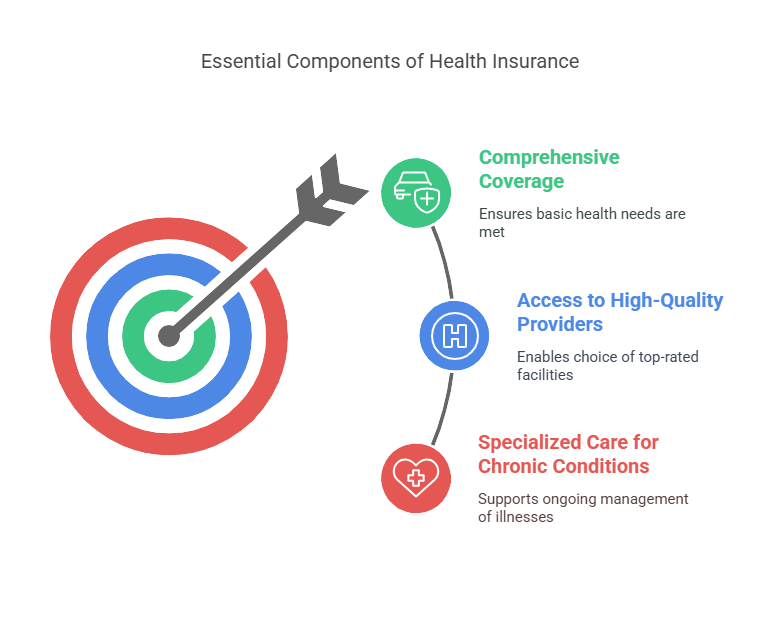

Comprehensive coverage:

- Employees value plans that cover annual check-ups, vaccinations, and screenings.

- Routine care helps catch potential health issues early, reducing long-term healthcare costs and improving employee well-being.

Access to high-quality providers:

- Employees want the ability to visit top-rated hospitals and specialists.

- A plan that covers treatment at well-known healthcare facilities improves confidence in the quality of care.

- Proximity to high-quality providers ensures employees receive timely care without long travel distances.

Specialized care for chronic conditions:

- Employees with chronic issues, such as diabetes, heart disease, and mental health disorders, need ongoing support.

- Health plans should cover medications, specialist visits, and treatment plans tailored to chronic conditions.

- Consistent access to specialists helps manage long-term challenges and reduces the risk of complications.

By providing access to specialized care and high-quality providers, employers create an environment where employees feel supported in managing their health.

Comprehensive health insurance that includes routine care, mental health services, and chronic condition management encourages employees to take a proactive approach to their health.

Comprehensive and Flexible Coverage

A strong plan should address both their immediate and long-term healthcare needs while providing flexibility to match individual circumstances.

Offering comprehensive coverage that includes dental, vision, mental health, and wellness benefits demonstrates that an employer is committed to supporting employee health in every aspect of life.

Flexibility in terms of premiums, deductibles, and co-pays also ensures that employees feel more in control of their healthcare decisions. If you need help with deciding on private health insurance, visit this site.

Specialty Coverage

Specialty coverage goes beyond the basics of medical and hospital care. Employees want plans that address a full range of healthcare needs, including preventive care, alternative treatments, and family-related benefits.

Expanding specialty coverage makes a plan more valuable and encourages employees to stay proactive about their health.

Key components of strong specialty coverage include:

Dental and Vision Coverage:

- Routine dental checkups, cleanings, and treatments.

- Vision exams, corrective lenses, and discounts on eyewear.

- Orthodontic and dental surgery coverage.

Alternative and Complementary Care:

- Chiropractic treatments for back pain and alignment issues.

- Acupuncture for pain management and stress relief.

- Massage therapy for muscle recovery and tension reduction.

Dependent Care and Maternity Benefits:

- Prenatal care and delivery costs.

- Postnatal care, including lactation consulting and pediatric visits.

- Coverage for fertility treatments and adoption assistance.

Mental Health and Wellness Support:

- Coverage for therapy sessions and mental health medications.

- Access to mental health hotlines and crisis support.

- Gym memberships and health coaching for physical and mental well-being.

- Preventive care screenings for early detection of health issues.

A strong specialty coverage plan addresses the needs of both single employees and those with families. Employees who feel supported in all aspects of their health are more likely to engage with wellness programs and take advantage of available healthcare options.

Customization Options

Not all employees have the same financial situation or healthcare needs, so giving them the ability to tailor their coverage helps create a stronger connection with the plan. Customization options allow employees to strike a balance between cost and coverage based on their priorities. Customization options that employees value include: Deductibles and Premiums:

- Higher premiums with lower deductibles for those who anticipate more frequent healthcare needs.

- Lower premiums with higher deductibles for those who want to minimize monthly costs.

- Options to adjust out-of-pocket maximums based on personal financial circumstances.

Co-Pays and Out-of-Pocket Costs:

- Tiered co-pay options based on the type of care or provider.

- Lower co-pays for preventive care to encourage proactive health management.

- Flexible co-insurance percentages for specialty treatments.

Health Savings and Reimbursement Accounts:

- Health Savings Accounts (HSAs) for tax-advantaged savings toward medical expenses.

- Flexible Spending Accounts (FSAs) to cover medical and dependent care costs.

- Employer-matching contributions to encourage long-term savings.

Provider Networks and Plan Structures:

- Open access to specialists without referrals.

- National and international networks for employees who travel frequently.

- Options for preferred provider organizations (PPOs) and maintenance organizations (HMOs).

When employees can customize their plan to match their specific financial needs, they are more likely to remain satisfied and engaged with the company’s benefits program.

Summary

A well-designed health insurance plan strengthens employee satisfaction and retention. By offering access to quality care, comprehensive coverage, and affordable costs, employers create a positive work environment where employees feel valued.

Providing transparency and ongoing support reinforces employee confidence and helps them manage it effectively. Investing in employee health benefits is a strategic decision that boosts overall company performance and workforce morale.