Debt consolidation—rolling multiple debts into a single, new loan or payment—can be a good idea, but it’s not for everyone. The best candidates are people with steady income, reasonable credit, and high-interest unsecured debts (like credit cards).

Consolidation can lower your monthly payments, simplify your finances, and even save you money on interest—but only if you qualify for better terms and avoid new debt. If you have poor credit, struggle with overspending, or face debt from causes like job loss or medical bills, consolidation may not solve the underlying issues and could make things worse.

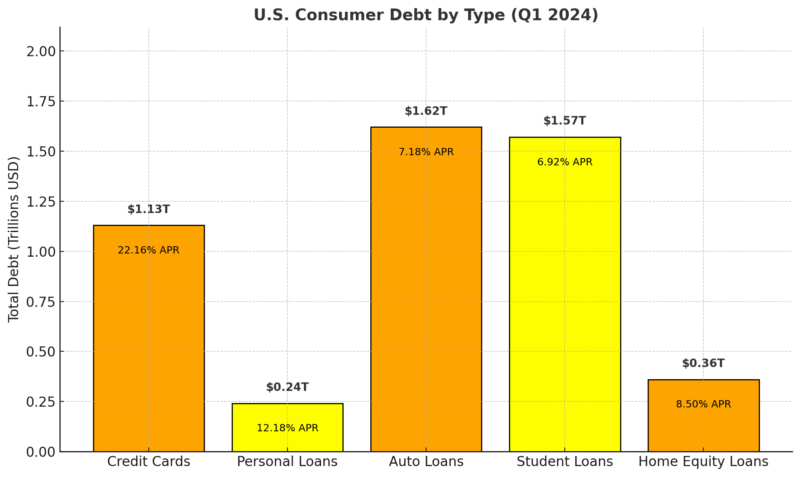

The real-world impact: In 2024, U.S. consumer credit card debt topped $1.13 trillion, with average credit card APRs exceeding 22%—the highest on record, according to CNBC. For many, consolidation loans or balance transfer cards offered rates as low as 7–15%, making them a valuable tool, but only for those who can secure them.

Common Forms of Debt Consolidation

Method

How It Works

Typical Interest Rate (2024)

Usual Term

Common Fees

Personal Loan

Lump sum loan used to pay off other debts

7–20% (credit-dependent)

2–7 years

Origination: 1–8%

Balance Transfer Card

0% intro APR to pay off cards, then regular APR

0% for 6–21 months, then 19–29%

NA

3–5% transfer fee

Home Equity Loan/HELOC

Secured by home equity, used to pay off debts

6–12%

5–30 years

Closing costs, possible annual fee

Debt Management Plan

Nonprofit agency negotiates payments/lower interest

8–15% (after negotiation)

3–5 years

Monthly plan fee

Debt consolidation is not a one-size-fits-all solution, and the best method depends on your credit score, financial habits, and overall debt load. Personal loans are a top choice for many because they offer fixed rates, fixed terms, and predictable payments.

If you have good or excellent credit (typically 670 or above), you may qualify for rates much lower than typical credit card APRs, helping you save substantially over the loan’s life. Origination fees (usually 1–8% of the loan amount) are common, so you need to factor them into your calculations.

Balance transfer credit cards attract many with their 0% introductory rates, allowing you to pay down high-interest debt interest-free for up to 21 months. However, these offers come with a catch: after the promotional period, the rate typically skyrockets (often 19–29%), so you must have a clear plan to pay off the balance before time runs out.

The 3–5% transfer fee means you’ll pay $300–$500 to transfer every $10,000 of debt, so it’s important to compare this with your expected savings.

Home equity loans and HELOCs are an option for homeowners, using the equity you’ve built in your home as collateral. These products often have lower interest rates compared to unsecured loans, and longer repayment terms, but they’re not without risk: if you can’t keep up with payments, you could lose your home.

Closing costs can also add hundreds or even thousands to your debt, so a careful comparison is critical.

Debt management plans (DMPs) through nonprofit agencies are another path. Instead of giving you a loan, these agencies negotiate with your creditors to lower your interest rates and monthly payments. You pay the agency each month, and they distribute the funds to your creditors.

While DMPs don’t directly affect your credit score, they may require you to close credit cards and stick to a rigid budget. Monthly plan fees apply, but often are much less than what you’d pay in interest if you kept making minimum payments on your own.

U.S. Consumer Debt by Type (Q1 2024)

Credit card debt stands out for both its sheer volume and its sky-high interest rate.

At $1.13 trillion, credit card balances are at an all-time high, and the average rate has climbed above 22%. For someone carrying a $10,000 balance, that’s more than $2,200 per year just in interest.

Personal loans are growing rapidly as Americans use them for everything from consolidating credit cards to covering medical bills or home repairs. While the average rate (about 12%) is much lower than for credit cards, it’s still a significant cost, especially for borrowers with fair or poor credit, who may pay 18–30% APR or more.

Auto and student loans make up massive chunks of household debt, but generally feature lower interest rates and more predictable payment structures. However, these types of loans are typically not included in debt consolidation (unless you refinance).

Home equity loans are notable because they offer lower rates, thanks to the collateral of your home, but also come with more risk if you can’t keep up with payments.

Debt Consolidation Pros and Cons

Pros

Cons

Simplifies payments (one monthly bill)

Requires good to excellent credit for the best rates

May lower monthly payments

Doesn’t solve overspending or underlying issues

Possible to reduce overall interest costs

Upfront fees and costs may apply

Can improve credit score if used responsibly

Risk of running up new debt after consolidation

Reduces the risk of late/missed payments

A longer repayment period can mean more interest paid

Nonprofit plans can help negotiate with creditors

Home equity options put your house at risk

The main appeal of debt consolidation is simplicity. Instead of juggling multiple bills and payment dates, you only have to remember one due date and one monthly payment, reducing stress and the risk of missed or late payments, which can hurt your credit score and add penalty fees.

A successful consolidation can also reduce your monthly payment, making your budget more manageable and freeing up cash for savings or emergencies.

If you qualify for a lower interest rate than you’re currently paying, you can also pay less in total interest over the life of the loan. In some cases, borrowers save thousands of dollars by consolidating high-interest credit card debt with a lower-rate personal loan.

Used responsibly, consolidation can even help your credit score. When you pay off revolving credit cards with a fixed-term installment loan, your credit utilization ratio drops, and you show a positive repayment history.

However, consolidation is not a cure-all. To get the best rates, you usually need a good or excellent credit score (670 or higher).

If your credit is poor, you may not qualify for better terms or may even face higher costs. Consolidation does not address overspending, so if you continue to rack up charges after consolidating, you’ll end up in deeper trouble.

Some methods, like personal loans and balance transfers, come with fees that eat into your savings. If you choose a longer repayment period to get a lower monthly payment, you may pay more in interest over the full life of the loan.

Home equity consolidation adds another risk: if you default, you could lose your home. Always be realistic about your ability to keep up with new payments, and don’t use consolidation as a way to avoid the root causes of debt.

Who Should (and Should Not) Consider Debt Consolidation

Best Candidates

Should Consider Alternatives

Those with multiple high-interest debts

Those with low/no income

Good or excellent credit (670+)

Credit score below 600

Steady, reliable monthly income

Unsecured debt load too high to manage

Committed to budgeting and avoiding new debt

Ongoing causes of debt (job loss, medical)

Want to simplify finances and pay off faster

Unwilling to change spending habits

Debt consolidation is not right for everyone, and being honest about your situation is crucial. The best candidates are people who have several high-interest debts—often from credit cards or personal loans—who are able to qualify for a new loan or credit card at a significantly lower rate.

They should have a reliable source of income to cover the new payment and a track record of making payments on time. Good credit is important; with poor credit, you may be denied or offered higher rates that don’t actually help you.

View this post on Instagram

A strong candidate for consolidation is also committed to a budget. That means not running up new balances on credit cards after consolidating, and having a plan for living within their means.

On the other hand, if your income is unstable or too low to cover basic expenses, if your debt load is unmanageable (for example, if your unsecured debt equals or exceeds your annual income), or if the causes of your debt—like job loss or major medical bills—haven’t been resolved, consolidation may simply delay the need for a more serious intervention like debt settlement, counseling, or bankruptcy. If you’re not prepared to change your spending habits, you could end up in a worse situation.

Free nonprofit credit counseling is a great way to get an objective opinion about whether consolidation is a good fit or whether you should explore other options.

Debt Consolidation by the Numbers

Statistic (2024)

Number/Percent

Source

Americans with 3+ credit cards

39% of households

Experian

Average consolidated loan amount

$12,000–$20,000

LendingTree

Typical credit score boost (after 12 months)

+20–40 points

TransUnion

% of borrowers who rack up new card debt

26% within 2 years

Federal Reserve

Typical balance transfer default rate

14%

CardRates.com

Debt consolidation is common in the U.S.—nearly 40% of households have three or more credit cards, creating a real need for financial organization. The average amount people consolidate is between $12,000 and $20,000.

For those who stick to their repayment plan and avoid new debt, consolidation can have a positive impact on their credit score—data shows an average boost of 20–40 points after a year, thanks to lower credit utilization and a more stable payment history.

@calebhammercomposer He Doesn’t Even Know What Consolidation Is😂 #financialaudit ♬ original sound – Caleb Hammer

However, the statistics also serve as a warning. More than a quarter of people who consolidate end up with new credit card balances within two years, essentially doubling their debt problem. This usually happens because the root cause of the debt (like spending beyond your means) wasn’t addressed before consolidating.

Additionally, default rates on balance transfer cards are significant: 14% of users miss payments or fail to pay off the balance before the promotional rate ends, resulting in higher rates and penalty fees.

The numbers make it clear: debt consolidation can offer a fresh start, but it’s not a magic solution. Success depends on having the right financial habits, a stable income, and the willingness to change behaviors that led to debt in the first place.